HVAC Tax Credits and Rebates: How to Save on a New AC

What tax credits are available for HVAC installations?

What are the Energy Home Improvement Tax Credits?

The energy home improvement tax credit allows you to claim tax credits for certain home improvement investments that improve home energy efficiency. All homeowners are allowed to claim up to $3200 annually on approved equipment installation or home improvements. The following are tax credits included for HVAC-related Energy Home Improvement with detailed information below:

- Air Source Heat Pump Tax Credit - For heat pump Installations

- Central Air Conditioners Tax Credit - For high efficiency central AC system installations

- Furnaces (Natural Gas, Oil) Tax Credits - For high efficiency gas and oil

- Electrical Panel Upgrade Tax Credit - To upgrade your electric panel for new AC installations

Air Source Heat Pump Tax Credit

- Homeowners can claim up to 30% of their heat pump installation cost with a maximum amount of $2,000. So if your heat pump is $5,000, you can claim $1,500. If the project is $10,000, you are maxed out at $2,000.

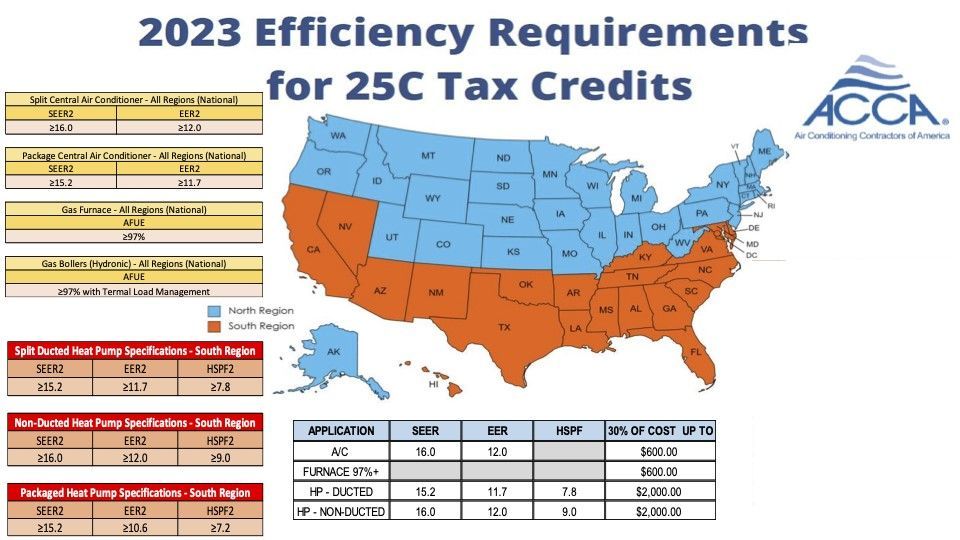

- Ducted heat pump need to have an Energy Star label

- Mini-split systems with SEER2 ≥ 16

Central Air Conditioners Tax Credit

- Homeowners can claim up to 30% of their installation cost with a maximum amount of $600. So if your central system is $1,500, you can claim $450. If the project is $5,000, you are maxed out at $600.

- ENERGY STAR certified equipment required with SEER2 > 16 is eligible.

Furnaces (Natural Gas, Oil) Tax Credits

- Homeowners can claim up to 30% of their furnace installation cost with a maximum amount of $600.

- System must be ENERGY STAR certified with AFUE > 97%.

Electrical Panel Upgrade Tax Credit

- Upgrading to a new AC system (heat pump or central) can often require electrical panel upgrades. The new energy home improvement tax credit now allows homeowners to credit some of the cost of upgrading their panel. Homeowners can claim up to 30% of their electrical panel upgrade cost with a maximum amount of $600.

- Must follow code and have a capacity of more than 200 amps,

- Installed must be in conjunction with or enables the installation and use of:

- any qualified energy efficiency improvements, or

- any qualified energy property (heat pump, central air conditioner, furnace, ect.)

Find out more on the

Energy Star Website.

What new rebates are available?

How do you know if you qualify for HEEHRA?

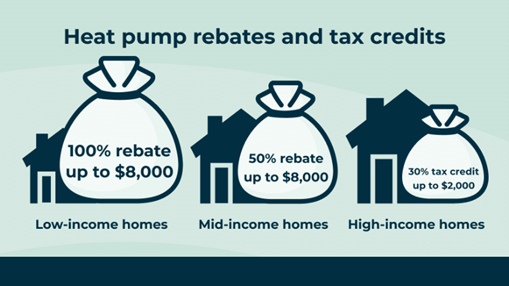

- If your household income is less than 80% of your state's median household income - you are eligible for 100% of the installation cost up to $8,000. So if you spend $10,000 for new heat pump system, you would receive the full $8,000

- If your household income is 80-150% of your state’s median income - you are eligible for 50% of the installation cost up to $8,000. So for a $10,000 heat pump, you could get $5,000 back.

- If your household income is more than 150 percent of your state’s median income - you are not eligible for these rebates. However, you still could be eligible for a tax credit.

How do I get the heat pump rebate?

Are there any local rebates available for my HVAC installation?

What rebates are available in the Birmingham Area?

- Switching from dual-heating system (electric heat pump with natural gas furnace) to a new, primary gas furnace with AC - Up to $400

- Switching from an electric heat pump furnace to a new natural gas furnace - Up to $800

Standard Homes: Dual fuel or mini-split systems replacement

- 15 SEER - $300/ton

- 16 SEER or greater - $350/ton

New Manufactured Homes: Replace electric furnace with heat pump

- 2 to 2.5 tons - $400

- 3 to 4 tons - $600

- 5 tons - $700

Existing Manufactured Homes:

- Converting from electric furnace to heat pump - $400/ton

- Dual fuel or mini-split system replacement

- 14 SEER - $250/ton

- 15 SEER - $300/ton

- 16 SEER or greater - $350/ton

Reach out Anytime, We are always here to help!

Thank you for contacting HVAC Home Pros.

We will get back to you as soon as possible.

Please try again later.

Quick & Reliable

We will answer any calls or questions in less than 5 minutes!

Don't be a stranger!

6 Office Park Cir suite 215, Mountain Brook, AL 35223

1201 Powder Plant Rd #7, Bessemer, AL 35022

Air Conditioning Services

AC Repair

AC Replacement

AC Installation

AC Maintenance

Mini-Split Systems

Heating Services

Heating Repair

Heating Replacement

Heating Installation

Heating Maintenance

Heat Pumps

All Rights Reserved | HVAC Home Pros - Air Conditioning Repair and Installation | AL # 22285